Far East’s Blank Spot: Starlink, Scandal and Internet Democracy in Indonesia

09 Jan 2024 Technology

I vividly recall my first encounter with the internet, a journey into the unknown, all experienced through a glowing box that transfixed my gaze. The internet was a treasure trove of information, accessible at the touch of a finger, offering everything I could imagine. My own inaugural experience with the internet was through my father's COMPAQ computer, a bulky, cube-shaped behemoth that I couldn't lift on my own. Back in the early 2000s, the most accessible and affordable network was a 64kb service known as Telkomnet Instant. The catchy jingle of their advertisement, “080989 four times, telkomnet instant...”, still echoes in my mind. I fondly remember the laser-like sounds emanating from my father's modem as it connected to this new, digital frontier.

Blankspot

Fast forward 20 years, and a revolutionary high-speed internet network utilizing satellite technology, akin to cable TV, emerged. Space X, a pioneering aerospace company, launched their high-performance internet service named Starlink. As an urban internet user, I personally view Starlink as akin to conventional broadband. However, for those in rural areas, forests, beaches, hills, or mountains where internet access is challenging, Starlink proves invaluable. Indeed, many network companies are striving to penetrate these internet 'blank spots'. Furthermore, the Indonesian government embarked on a massive infrastructure project called the Palapa Ring (Recently launched SATRIA-1 satellite), reportedly costing trillions of rupiah, only to end up mired in a corruption scandal. A significant challenge for network companies in these blank spots is the instability of other infrastructures, like electricity. One of our customers mentioned that power outages in their area could last up to a week, rendering the internet unusable. The Service Level Agreement (SLA) provided surpasses critical levels. Additionally, the cost in these less developed areas is exorbitantly higher compared to regions densely wired with fiber optics, like major Indonesian cities.

Internet Democracy

Starlink, a potential solution for residents in internet 'blank spots', faces a challenging path to enter the Indonesian market. The difficulties for Starlink, particularly concerning data security and competition with local providers, are manifold. Although there have been discussions between the Indonesian central government and Elon Musk, the majority shareholder of SpaceX, the reality presents ongoing obstacles. Starlink is required to obtain specific certifications, such as the Landing Right license and the Data Exchange, Storage, and Management for Closed Communication (JARTUP) from Kominfo.

This regulatory landscape is likely influenced by discussions with associations like APJII, the Internet Service Provider Association of Indonesia, which has a large membership base (about 1,000 members) spanning telecommunications, fiber optics (ISP), and satellite companies. According to released articles, only one state-owned enterprise is allowed to trade Starlink's equipment and services. However, it raises questions when this state-owned enterprise openly markets these products, despite Starlink's equipment not being certified and the company not being listed as an Authorized Reseller on Starlink's official website (https://support.starlink.com/?topic=9b7746f8-e2ee-0fd4-7ffb-3bbe0ab35cbc). Further investigation reveals that this enterprise does not mention Starlink on their website, instead branding the service under their own name, "Fruitstar" (a pseudonym), and using a backhaul system.

This service is provided only for B2B, but it begs the question of whether this constitutes a viable business strategy. Such a scenario hints at the complexities and potentially questionable practices in navigating the telecommunications market in Indonesia, especially for foreign entities like Starlink.

Starlink

Setting aside the market entry challenges, let's delve into the performance and pricing of Starlink, which has now entered its third generation (GEN 3) as a Low Earth Orbit (LEO) internet service provider. A notable advancement in GEN 3 is improved performance and the reintroduction of the Ethernet port, which was absent in GEN 2.

In terms of speed, Starlink's website indicates that its Standard service can achieve download speeds of up to 220 Mbps and upload speeds of up to 25 Mbps. Comparing this to the Very Small Aperture Terminal (VSAT) types available in Indonesia, there are different frequency bands like C-band, Ku-band, and Ka-band. Starlink operates on various frequency bands, including Ka-band, Ku-band, V-Band, and even X-Band. The reason for these diverse frequencies is tied to Starlink's multifunctional capabilities, which are categorized into five main functions:

1. Transmission from User Antenna to Satellite: This is used for sending data from the user's antenna to the satellite.

2. From Satellite to Gateway Transmission: This function is utilized for accessing websites and other media.

3. Backup Transmission from User Antenna: It serves as a redundancy for the primary transmission.

4. Information Transfer from Backup Gateway to Satellite: This is used for sending data from the backup gateway to the satellite.

5. Telemetry and Control: This involves the telemetry on the antenna and control through the Starlink app.

These varied frequencies allow Starlink to efficiently manage different types of data transmission and ensure robust and reliable communication between the user equipment, satellites, and ground stations. This technical versatility is a key aspect of Starlink's high-performance capabilities in providing internet services.

The issue of signal interference from other frequency waves, such as those from the sun, other satellites, or even TV and radio antennas, is an important consideration for any satellite-based communication system like Starlink. Starlink's antenna is sophisticatedly designed to mitigate such interference.

Each Starlink antenna comprises 1280 small individual antennas. These mini antennas have specifically sized plates, with the upper antenna measuring 1.28 cm and the lower one 1.15 cm. This design is crucial for narrowing the frequency range of Starlink to between 11.7 and 13 GHz, which falls within the microwave class. By operating within this specific frequency range, Starlink minimizes the potential for interference from other frequencies.

Regarding the technical capabilities, Starlink's system can send data (uplink) in as little as 74 milliseconds and receive data (downlink) within 926 milliseconds per second (1 second = 1000 milliseconds). It uses a 64QAM digital modulator technique, allowing for a performance of up to 540 Mbits/sec to satellites located approximately 550 km from Earth. Moreover, this technology ensures low latency, which is a critical factor for efficient and reliable internet service.

This performance is indeed intriguing, especially when considering that Starlink's speed is comparable to 5G capabilities, which are currently being heralded as a strategic government project for internet provision in blank spot areas. The ability of Starlink to deliver high-speed internet with low latency in areas where traditional broadband or even 5G may not be feasible or efficient positions it as a potentially game-changing technology in the telecommunications industry.

Discussing Starlink's performance in Indonesia, particularly given its unique geography as an archipelago, is indeed fascinating. The diverse landscape and varied infrastructure across different islands can significantly impact internet service performance. Let's look at the trials conducted in various locations: Palembang, Balikpapan, Jakarta, Makassar, and FakFak, using the Starlink Standard dish.

| Location | Download | Upload | Latency |

| Palembang | 27.55 Mbps | 37.24 Mbps | 102 - 247 ms |

| Pontianak | 22.51 Mbps | 1.82 Mbps | 34 - 187 ms |

| Jakarta | 279 Mbps | 19.4 Mbps | 30 - 117 ms |

| Makassar | 304.61 Mbps | 28.83 Mbps | 67 - 121 ms |

| FakFak | 35.6 Mbps | 6.90 Mbps | 51 - 219 ms |

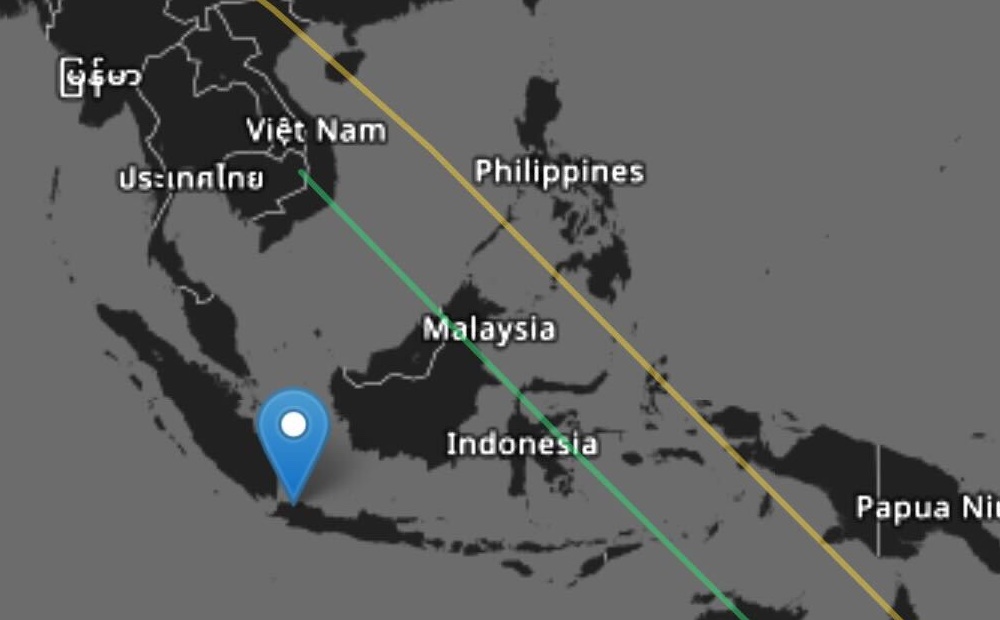

In Indonesia, there is a noticeable disparity in the performance of Starlink's internet service across different regions. The westernmost parts of Indonesia are experiencing significantly lower performance compared to the central and eastern regions. This variation is evident not only in overall service quality but also in terms of latency. Higher latency in the western regions suggests a greater distance for data transmission between the dish antenna and the satellites. An examination of the Starlink satellite orbits using the Find Starlink app reveals differences in the satellite's orbital paths between day and night, which in turn affects the performance of Starlink's internet service.

According to the above images on Starlink's day and night orbital paths, Sulawesi and East Kalimantan emerge as key intersecting points in the satellite's orbit, nearly eliminating any 'dead zones' in these areas. This is evident from the high-speed performance metrics observed. In Sumatra, while Starlink's internet coverage is available, it suffers from relatively high latency. Similarly, in the eastern regions of Indonesia, a speed test sample from the FakFak mountains shows significant latency, yet the download and upload performance are sufficient for local internet needs. Consequently, it can be concluded that Starlink's internet performance surpasses that of existing satellite-based internet services in Southeast Asia. This development is particularly beneficial for residents in areas with no internet coverage. Current reports indicate that Starlink is awaiting approval from the Ministry of Communication and Informatics (Kominfo) in Indonesia and is required to establish a data center within the country, in compliance with Government Regulation No. 52 of 2000 concerning Telecommunications Operations and the Minister of Kominfo Regulation No. 13 of 2019 on the Provision of Telecommunication Services.

Competitor

Given the high demand for internet access in areas lacking coverage, Starlink isn't the only company venturing into the Low Earth Orbit (LEO) internet business. OneWeb, another notable player in the field, offers similar services. OneWeb has a slight edge over Starlink in the Indonesian market, having already forged a partnership with PT Indosat Ooredoo Hutchison Tbk to enter the internet business in Indonesia. This collaboration is expected to accelerate and streamline the implementation of the government's much-anticipated 5G project. Presently, I am still gathering data on the performance and quality of OneWeb's services. As of now, the information available suggests that OneWeb is primarily focused on Business-to-Business (B2B) services and has not yet ventured into the retail market, unlike Starlink. I plan to delve deeper into OneWeb's operations and offerings in a future discussion, as the current information is limited.

In addition to OneWeb, there's a new venture named Project Kuiper, spearheaded by Amazon founder Jeff Bezos. As a world-renowned billionaire who also owns the aerospace company Blue Origin, Bezos' Kuiper project operates independently of his space venture. Instead, it aligns with Amazon's hardware business line, akin to the Kindle Tablet. Project Kuiper aims to establish a satellite constellation providing internet to regions with sparse connectivity. For example, even locations within a 60-minute drive from an Amazon office can suffer from poor connectivity. Reportedly, Project Kuiper will deploy a constellation of 3,236 satellites orbiting between 590 to 630 kilometers above the Earth. The service is expected to be available to users by late 2024, initially with a limited number of satellites. By 2026, the project targets to have launched half of its total satellites. Considering the orbital distance and the number of satellites planned, Kuiper's performance might not yet match Starlink, which has already deployed 5,420 satellites, nearly twice Kuiper's total target. However, Project Kuiper's antenna devices are also aimed at the retail market, similar to Starlink. They come in three classes: ultra-compact with speeds up to 100mbps, standard class offering 400mbps, and the enterprise class capable of reaching 1gbps. This diversification makes the LEO internet business increasingly intriguing due to the variety of options available.

Closure

Let's explore how the burgeoning Low Earth Orbit (LEO) internet industry can propel Indonesia towards becoming a nation with a substantial digital economy, aided by space-based network infrastructure. The introduction of internet satellites like Starlink, OneWeb, and Project Kuiper holds the potential to significantly reduce Indonesia's internet coverage gaps. Of course, this assumes compliance with existing regulations, enabling these internet services to be accessible to users in Indonesia. With a bit of support from the Indonesian government and the willingness of LEO internet companies to invest in the country, Indonesia's ambitious goal of achieving a 'Golden Era' by 2045 could well be within reach.

Author: Untag Pranata

[References]

Starlink: https://www.starlink.com/

Youtube: https://www.youtube.com/watch?v=qs2QcycggWU

American TV: https://www.americantv.com/what-frequency-does-starlink-use.php

Kompas: https://www.kompas.id/baca/ekonomi/2023/11/13/pengurusan-izin-starlink-masih-berproses-di-kominfo

CNN Indonesia: https://www.cnnindonesia.com/teknologi/20231128142241-213-1030046/deret-syarat-ketat-buat-starlink-masuk-ri-versi-atsi

OneWeb: https://oneweb.net/

About Amazon: https://www.aboutamazon.com/news/innovation-at-amazon/what-is-amazon-project-kuiper